BY DAYO ADESULU

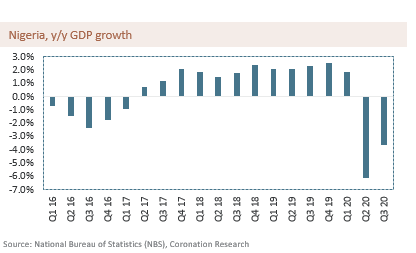

Experts in data analysis have responded to the recently released data by the National Bureau of Statistics (NBS) revealing Nigeria’s GDP data for Q3 2020, with a decline of -3.62% y/y with Non-oil GDP falling by just -2.51% y/y.

The Non-oil GDP growth drivers were the Telecoms sector (+17.36% y/y) and Agriculture (+1.39% y/y).

According to the data analysis released by Coronation Research, the NBS data are considerably better than expected, especially the Non-oil GDP data and show several sectors – notably Manufacturing – adapting to difficult conditions in consumer and FX markets. After 1.87% y/y growth in Q1 and a -6.10% y/y contraction in Q2, it now looks like the IMF’s June forecast a full-year recession of -4.3% y/y is on the pessimistic side.

While considering the positive implications for equities. it argued that the stock market is undergoing a bull run, which is consistent with seeing this as a V-shaped recession with a clear exit early next year. It explained that this is plausible if Brent crude prices recover to US$50.00/bbl (currently US$48.21/bbl), it is less plausible if oil prices falter. The data analysts also pointed out the growth in the telecoms sector, adding that the sector continues to grow with data partly replacing lost voice revenues.

Speaking on negative for inflation, Coronation analysis shows that the slowdown in Trade is associated with a steep fall in FX transaction volumes and a fall in the Naira in the parallel market, bringing increases in input costs.

For agriculture production, it averred that agric production may not be growing as fast as population growth, adding that October’s 14.23% y/y inflation (September: 13.71% y/y) could rise further.

On neutral-to-negative implications for interest rates, Coronation Research analysis says: ”The Monetary Policy Council of the Central Bank of Nigeria retained its headline rate at 11.50% last Tuesday, a clear signal that it is happy with low market interest rates. Going into Q1 2021 fixed income liquidity may not be as high as during 2020, with the possibility that rates may begin to move up gently during the year.

For the comprehensive analysis copy this and paste on your browser https://www.coronationmb.com/wp-content/uploads/sites/3/2020/11/Coronation-Research-15-Q3-2020-GDP-Report_27-November-2020-1.pdf

|